Private Investment Prevents Steeper Fall

Fresh investment in the first quarter of FY2025 (Q1/FY2025) declined by 27.08 percent on a Y-o-Y basis, due to the prolonged General and State elections, which impacted the fresh investment announcements by the Central and State agencies. Despite the political uncertainty, that generally prevails during the General election period, the Private sector posted positive growth in new projects. Among the states, Maharashtra managed to attract one-fourth of the total fresh investment announced in the first quarter of the current fiscal year.

According to the 95th Survey of Projects Investment in India, Q1/FY2025 witnessed the announcement of 2,312 new projects worth Rs 6,37,309.50 crore. In the same period, a year ago, the country saw the announcement of 2,833 new projects with a total investment commitment of Rs 8,73,971.82 crore. This indicated a sharp fall of 27.08 percent on a year-on-year basis.

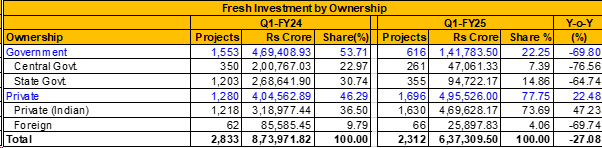

Projex by Ownership

The disruption caused by the General and State elections resulted in reduced fresh investments by Central and State-controlled agencies. During the election period, the government agencies were barred from announcing any major new investment proposals. Alongside the Central government, major states like Andhra Pradesh, Odisha and Arunachal Pradesh were also engaged in the election process.

As a result, during Q1/FY2025, fresh investment declined sharply by 69.80 percent in the Government sector. As against 1,553 projects worth Rs 4,69,408.93 crore in Q1/FY2024, only 616 projects worth Rs 1,41,783.50 crore were announced in Q1/FY25. Consequently, the Government sector's share in total fresh investment more than halved from 53.71 percent to 22.25 percent.

Within the Government sector, the year on fall was deeper at 76.56 percent in the Central government sector. During the first quarter, the Central Government agencies announced 261 new projects worth Rs 47,061.33 crore in Q1/FY2025, prominently down from 350 projects worth Rs 2,00,767.03 crore in Q1/FY2024. The State government agencies announced 355 new projects worth Rs 94,722.17 crore in Q1/FY2025, compared to 1,203 projects worth Rs 2,68,641.90 crore in Q1/FY2024, indicating a decline of 64.74 percent.

But for the increased investment commitments by the Private sector during Q1/FY2025 the decline in fresh investment would have been steeper. During this period, a total of 1,696 new projects were announced, valued at Rs 4,95,526 crore, compared to 1,280 projects worth Rs 4,04,562.89 crore in Q1/FY2024, marking an increase of 22.48 percent. As a result, the private sector’s share in total fresh investment rose from 46.29 percent to an impressive 77.75 percent. Notably, the Private sector dominated major sectors like Manufacturing, Mining, Electricity, and Infrastructure, accounting for a share of 99.66 percent, 62.18 percent, 73.60 percent, and 74.80 percent of the total fresh investment, respectively.

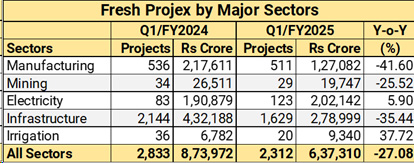

Projex By Sector

The Manufacturing Sector, in Q1/FY2025, saw the announcement of 511 new projects worth Rs 1,27,081.65 crore. This indicated a substantial decline of 41.60 percent compared to a year ago announcement of 536 projects worth Rs 2,17,611.47 crore. Consequently, the sector's share in total fresh investment decreased from 24.90 percent in Q1/FY2024 to 19.94 percent in Q1/FY2025. Textiles, Drugs & Pharma, Plastic Products, Aluminium, Cement, and Electronics sectors attracted sizeable new investment within this sector.

JSW Energy PSP Eleven’s Rs 25,000 crore Electric Vehicle campus planned at Baranga in Odisha was the largest project announced during the Survey period. The company intends to manufacture Electrical vehicles, Buses, and Lithium-ion cell batteries.

The 12 new Cement projects intend to add around 46 mln. tpa of cement capacity in the next couple of years. Sanghi Industries and Ambuja Cements, both part of the Adani Group, plan to establish 10 million tonnes per annum (tpa) cement capacities each in Gujarat and Chhattisgarh, respectively at a total investment of Rs 12,890 crore.

In the Metals sector, Lloyds Metals & Energy plans Rs 5,852 crore investment in a new pellet production facility in Ghugus, Maharashtra and Epsilon Advanced Materials is investing Rs 5,000 crore in a new cathode production facility.

In the Electronics sector, Tel Components plans to set up a new mobile phone manufacturing facility in Tamil Nadu, at a cost of Rs 6,751 crore. The plant will have a production capacity of 108,000 mobile phones per day. In Telangana, Kaynes Semicon proposes establishing a green-field semiconductor assembly and testing facility with an investment of Rs 2,850 crore.

Around 46 Drugs and Pharma projects mostly for manufacturing formulations and API at a total cost of Rs 3,274 crore.

Mining Sector, despite attracting three mega projects, posted a sharp fall of 25.52 percent on a year-on-year basis. In all, 29 new projects worth Rs 19,746.69 crore were announced in Q1/FY2025, compared to 34 projects worth Rs 26,511.42 crore in Q1/FY2024. A Rs.8,780 crore Gare Palma Sector-I Coal Mining project of Jindal Power in Chhattisgarh and a Rs 4,246 crore Oil & Gas Exploration (Gulf of Khambhat) project of Vedanta were the two prominent mining projects announced during the Survey period.

The Electricity sector saw a positive growth of 5.90 percent on a year-on-year basis, with 123 new projects worth Rs 2,02,141.96 crore announced in Q1/FY2025. The increased investment lifted the sector's share in total fresh investment from 21.84 percent to 31.72 percent. Increased investment commitments by the Private sector in the recent period in the Pumped Hydel power and Solar power projects contributed to this positive growth during the Survey period.

The 123 new proposed projects include 61 mega projects with a total investment intention of Rs 1,74,759.40 crore. This includes four Pumped Hydel Power projects, four thermal Power projects and 61 Solar & Wind Power projects. Together, they intend to add a fresh generation capacity of 29,104 MW.

The Infrastructure (Services & Utilities) sector witnessed a decline in both project count and investment value. In Q1/FY2025, 1,629 projects worth Rs 2,78,998.90 crore were announced, compared to 2,144 projects worth Rs 4,32,187.71 crore in Q1/FY2024. This marks a significant decline of 35.44 percent in investment value, reducing the sector's share in total fresh investment from 49.45 percent to 43.78 percent. The impact of the election was notably pronounced in this sector, which relies heavily on government projects.

The two prominent investors in Roadways projects in Q1/FY2024, Maharashtra State Road Devp. Corpn. (26 projects, Rs 47.394.63 crore) and Mumbai Metropolitan Region Devp. Authority (4 projects, Rs 63,791.51 crore) did not announce any high-ticket projects in Q1/FY2025. Additionally, National Highways Authority of India (NHAI), a major investor in Highways projects, announced only nine projects with a total outlay of Rs 3,380.86 crore in Q1/FY2025. A year ago during the same period, the company had announced 23 highway projects worth Rs 36,914.29 crore. As a result, the total capex intentions in the Roadways sector came down sharply from Rs 1,79,894.37 crore in Q1/FY2024 to Rs 18,164.66 crore in Q1/FY2025.

The election-related restrictions also affected fresh investment announcements in other infrastructure sectors like Railways, Ports, Airports, Power Distribution and Pipelines.

Among the sub-sectors, Real Estate, primarily driven by Private players, defied the declining trends and posted an impressive year-on-year growth of 117.32 percent. As against, 546 projects worth Rs 85,733.31 crore announced in Q1/FY2024, the Survey period saw the announcement of 899 projects worth Rs 1,86,315.55 crore. Around 80 percent of the proposed investment is spread across five states – Maharashtra, Haryana, Telangana, Karnataka and Gujarat.

The Irrigation sector also witnessed a positive growth of 37.72 percent, with 20 new projects worth Rs 9,340.30 crore announced in Q1/FY2025, compared to 36 projects worth Rs 6,782.21 crore in Q1/FY2024. The Rs 4,350 crore Narayanapet-Kodangal Lift Irrigation Scheme by the Irrigation & CAD Department, Telangana, and the Rs 3,263.54 crore Sitapur Hanumana Pipe Irrigation Scheme by the Water Resources Department, Madhya Pradesh were the two mega projects announced in Q1/FY2025.

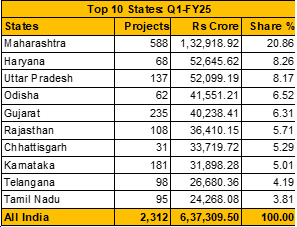

Projex By States

Among the major states, Maharashtra maintained its top position despite a substantial drop in investment value. While Karnataka and Gujarat saw significant declines in their ranks, states like Uttar Pradesh and Odisha showed resilience, with slight improvements in their rankings. New entrants, Haryana and Rajasthan recorded strong growth.

Maharashtra maintained its top position despite a substantial drop in investment value (down by 54.47 percent). In all, the state attracted 588 projects worth Rs 1,32,918.92 crore during Q1/FY2025 as against 557 projects worth Rs 2,91,841.39 crore attracted a year ago. Real Estate (Rs 66,675.93 crore), Electricity (Rs 26,903 crore) and Steel (Rs 9,142 crore) were the major sectors which contributed around 77 percent of the fresh investment the state attracted. Since the bulk of the investment in these sectors is from the Private sector, the state managed to corner around one-fourth of the total private investment announced during the Survey period.

Haryana entered the top 10 list at 2nd position by attracting 10 mega Real Estate projects and a mega thermal power project. During the first quarter of FY2025, the state attracted 68 new projects worth Rs 52,645.62 crore. Of this, 35 were Real Estate projects located around the Gurugram area at a total investment of 42,815.87 crore.

The third-ranked Uttar Pradesh improved its ranking from fourth position in Q1/FY2024 to third in Q1/FY2025. The state attracted 137 projects worth Rs 52,099.19 crore. Three mega Electricity projects (Rs 33,138 crore) and 22 Real Estate projects (Rs 8,323 crore) accounted for the bulk of the fresh investment the state attracted.

Aided by the Rs 25,000 crore Electric Vehicles project of JSW Energy PSP Eleven Odisha improved its rank from 6th to 4th position, showing a relatively smaller decrease in investment value (down by 10.94 percent). In all, 62 projects worth Rs 41,551.21 crore were announced in Q1/FY2025.

Gujarat, one of the favourite states of private investors, moved from 3rd to 5th position, registering a decline in investment by 51.08 percent on a year-on-year basis. In all, 235 new projects worth Rs 40,238.41 crore were announced in Q1/FY2025.

Outlook for FY2025

While the fresh investment announcements were severely hampered in the Public sector by the elongated General and State election process, the year-on-year increase registered in the Private sector capex commitments is an encouraging feature.

With the newly formed Central government’s ministries looking afresh at their capex plans and the state governments lining up new investment plans after presenting their current year’s budgets in the first quarter, the quantum of fresh investment is expected to increase steadily in the coming months of fiscal year 2025.

The Private sector, seeking industry-friendly reforms in the Union Budget 2024-25 to be presented later in July 2024, is poised to step up its capacity expansion programme in the second half of FY2025. Sectors like Cement, Steel, Electronics, Automobiles, Real Estate, and Electricity would see increased private investment.

Additionally, with the revival in Central government investment in the Infrastructure (Roadways, Railways, Ports, etc.) in the coming months, Projects Today expects positive growth in new capital investment in FY2025. We also expect some of the super mega projects announced in the recent past, especially in the sunrise industries, to gain traction in this fiscal.

About Projects Today

Projects Today is India's largest online databank on new and ongoing projects in India. The website, launched on 8 September 2000, aims to provide the required foresight to its clients based on sectoral insights its research team possesses. The project-related information provides an invaluable marketing resource to assist the business development efforts of the organisations that focus on the new projects market. It is widely used by the project fraternity, primarily, as a business opportunity identifier.

Projects Today conducts Survey of Project Investment, at the end of every financial quarter to gauge the trends in projects investment in India by sectors, state, ownership, etc.

Disclaimer : The opinions expressed within this interview are the personal opinions of the interviewee. The facts and opinions appearing in the answers do not reflect the views of Indiastat or the interviewer. Indiastat does not hold any responsibility or liability for the same.

"Government’s Borrowing Plan is Broadly in Line with Expectations"... Read more