Fresh Investment Bounces Back

In the first quarter of this fiscal year, major project announcements by central government agencies were postponed due to the election code of conduct being in effect during the general election. During this period, the private sector also delayed unveiling some of their mega-ticket capital expenditure plans. However, with a stable government reinstated at the Centre on 9 June 2024, the second quarter of FY25 saw an upsurge in investment announcements by both the public and private sectors. This led to an impressive 42.52 percent rise in new project investments in Q2/FY25. Notably, except for Q4/FY24, when total investments of Rs 13,49,045.31 crore were announced, the fresh investments of Rs 9,21,081.08 crore announced in Q2/FY25 represent the second highest level in the past one and a half years.

As per the 96th Survey of Projects Investment in India, in Q1/FY25, a total of 2,443 new projects were announced, with an investment of Rs 6,46,293.83 crore. In Q2/FY25, this increased to 2,684 projects, with total investment commitment rising to Rs 9,21,081.08 crore. Reflecting the increased confidence of the project promoters, the number of mega projects (cost of Rs 1,000 crore or more) increased from 132 projects worth Rs 4,01,772.89 crore in Q1/FY25 to 173 projects worth Rs 6,37,988.45 crore in Q2/FY25.

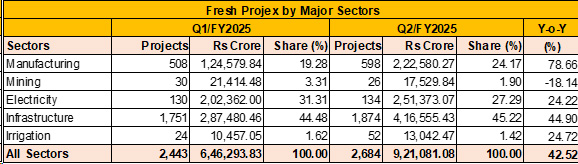

By Sector

The second quarter of FY2025 witnessed a promising upswing in overall project investment activity, marked by significant growth in project announcements, especially in Manufacturing and Infrastructure. While the Electricity sector maintained steady growth, underpinned by a strong interest in renewable energy projects, mixed performances were seen in the Mining and Irrigation sectors.

Manufacturing: In Q1/FY25, the manufacturing sector saw 508 projects with an investment of Rs 1,24,579.84 crore, comprising 19.28 percent of the total investment in that quarter. The sector bettered its performance in Q2/FY25, with 598 projects and an investment of Rs 2,22,580.27 crore, representing 24.17 percent of total investments. The Q-o-Q growth in investment value was an impressive 78.66 percent, highlighting increased capex building activities in sectors like Steel, Cement, Automobiles, Electronics, etc.

In the Steel industry, two high-ticket projects were announced. Lloyds Metals & Energy announced a Rs 16,580 crore integrated steel unit in Jairampur, Maharashtra, and Mukand Sumi Special Steel announced a Rs 3,468 crore project in Karnataka. In the Cement sector, notable investments included Goldcrest Cement's Rs 2,500 crore project in Madhya Pradesh and Meghatop Cement's Rs 2,450.55 crore project in Meghalaya. In the Machinery and Electronics sector, two significant capital expenditure projects were JSW Energy PSP Eleven's Rs 25,000 crore Lithium-Ion Battery project in Nagpur, Maharashtra, and Avaada Electro's Rs 13,659 crore Solar Cells and Modules project in Maharashtra. In the Automobile sector, JSW Green Mobility announced a Rs 27,200 crore investment in a Hybrid Electric Vehicles project, while Toyota Kirloskar Motor undertook a Rs 21,273 crore project for passenger cars.

Mining: The Mining sector had 30 new projects with a total investment of Rs 21,414.48 crore in Q1/FY25, contributing 3.31 percent to the overall investments. The sector could not retain its tempo in Q2/FY25. With 26 new projects and an investment of Rs 17,529.84 crore, the sector's share reduced to 1.90 percent and growth in investment declined by 18.14 percent. Eastern Coalfields, Ambuja Cements and Bharat Coking Coal announced a couple of mega coal mining projects in this quarter.

Electricity: The Electricity sector, encompassing conventional power generation and green power projects like pumped Hydel projects and Solar power, registered a Q-o-Q growth of 24.22 percent. In Q1/FY25, 130 projects were initiated with investments worth Rs 2,02,362 crore, making up 31.31 percent of total investments. This increased to 134 projects in Q2/FY25, with an investment of Rs 2,51,373.07 crore, accounting for 27.29 percent of the total. The appetite of private power developers to set up Pumped Hydel power projects and Solar/Wind power projects remained intact in Q2/FY25 too.

The sector attracted 57 mega projects worth Rs 2,29,280 crore. Some of the prominent projects announced in the Q2 were a Rs 15,000 crore Solar-Wind based power project of Torrent Power, a Rs 14,000 crore coal-based power project of NTPC, and a Rs 13947.50 crore Hydel-based power project of SJVN.

Infrastructure: Dominating the investment landscape, the Infrastructure sector accounted for the largest share of total investments in both quarters. Q1/FY25 saw 1,751 projects with investments amounting to Rs 2,87,480.46 crore, which was 44.48 percent of the total investment. With the announcement of mega Road projects, the share further increased in Q2/FY25. With 1,874 projects worth Rs 4,16,555.43 crore, the sector experienced a Q-o-Q growth of 44.90 percent in investment value and improved its share in total investment to 45.22 percent. The sector attracted 70 mega projects worth Rs 2,12,477 crore in Q2/FY25.

Among the sub-sectors, Roadways, Railways, Power Distribution, Construction and Data Centres accounted for the bulk of the new investments announced during Q2.

Fresh investment in Roadways saw an extraordinary jump of 242.74 percent, growing from Rs 19,012.26 crore in Q1 to Rs 65,161.76 crore in Q2. This resulted in an increased share of total investment from 2.94 percent to 7.07 percent, indicating a major boost in road infrastructure projects.

The National Highways Authority of India (NHAI) emerged as the leading promoter in this list, with 41 projects announced during the Survey period. These projects carried a total investment value of Rs 21,310.38 crore. NHAI did not announced many projects in Q1 due to election-related restrictions. Next was the Maharashtra State Road Development Corporation Ltd. (MSRDC), which announced six projects amounting to Rs 10,955.30 crore. City & Industrial Development Corporation of Maharashtra Ltd. (CIDCO) was also part of this list with three projects worth Rs 6,046 crore. CIDCO primarily focused on urban development, especially in the planned city of Navi Mumbai and its surrounding areas.

Investment in the Railway sector grew by 191.46%, from Rs 9,407.72 crore in Q1 to Rs 27,419.65 crore in Q2. Its share also rose from 1.46% to 2.98%, showing a renewed focus on rail infrastructure expansion.

The Power Distribution sector experienced significant growth, with investment rising by 648.71% from Rs 5,671.20 crore in Q1 to Rs 42,460.88 crore in Q2. Modernisation of last mileage distribution networks and installation of modern meters undertaken by several state governments led to a healthy increase in fresh investment.

Total fresh investment in the Construction Sector, comprising Commercial Complexes, Real Estate, Industrial Parks, Storage and Distribution, and Data Centres, fell by 4.59%, from Rs 2,14,157 crore in Q1 to Rs 2,04,333 crore in Q2. Investments in real estate declined significantly by 22.53%, from Rs 1,89,617.09 crore in Q1 to Rs 1,46,896.65 crore in Q2. Its share also dropped from 29.34% to 15.95%, signaling a slowdown in residential and commercial real estate projects. While on a Q-o-Q basis, fresh investments increased in Commercial Complexes, Industrial Parks, and Data Centres, a 22.53 percent drop in fresh investment in the Real Estate sector pulled down the overall growth of the Construction sector in Q2/FY25.

Irrigation: Investment in irrigation remained relatively modest compared to other sectors. Q1/FY25 recorded 24 new projects with a total investment of Rs 10,457.05 crore, contributing 1.62 percent to the quarter's overall investment. The number of projects increased to 52 in Q2/FY25, with a total investment of Rs 13,042.47 crore, reducing its share to 1.42 percent. Narmada Valley Devp. Authority of Madhya Pradesh with 4 large projects worth Rs 4,820 crore was the major investor in this sector in Q2.

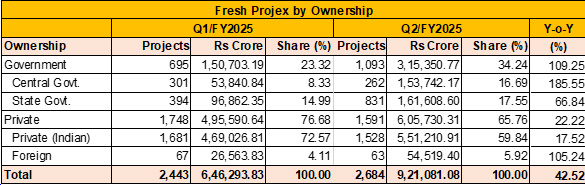

By Ownership

The Q2 of FY2025 saw a strong government-led investment push with the sector's share in total investment rising from 23.32 percent in Q1 to 34.24 percent in Q2. As a result, the private sector saw its share in the total investment pie decline from 76.68 percent in Q1 to 65.76 percent in Q2. Nevertheless, private investment remained the dominant force in both quarters.

The revival in the government capex is crucial for sustaining the capex cycle and ensuring long-term infrastructure growth, especially in strategic areas like transportation, urban development, and rural infrastructure.

Government Sector: In Q1/FY25, there were 695 new projects under the government category, with a total investment of Rs 1,50,703.19 crore, making up 23.32 percent of the total investments. In Q2/FY25, the number of government projects increased significantly to 1,093, with the investment value more than doubling to Rs 3,15,350.77 crore, representing 34.24 percent of total investments. The Q-o-Q growth in investment value was 109.25 percent, reflecting the re-entry of the government sector into the capex arena in Q2.

The Central Government announced 301 projects worth Rs 53,840.84 crore in Q1/FY25, constituting 8.33 percent of the total investment. In Q2/FY25, the central government initiated 262 projects worth Rs 1,53,742.17 crore, significantly increasing its share to 16.69 percent. The Q-o-Q growth in investment by the central government was 185.55 percent, indicating its intention to increase the investment in the infrastructure to raise the overall investment activities in the country.

State Governments also ramped up their investments, with 394 projects in Q1/FY25 and a total investment of Rs 96,862.35 crore, contributing 14.99 percent to the overall investment. This increased to 831 projects in Q2/FY25, with investments worth Rs 1,61,608.60 crore, making up 17.55 percent of the total. The Q-o-Q growth in state-level investments was 66.84 percent, highlighting the efforts by state governments to augment regional infrastructure like Water supply schemes, Roadways, and Tourism.

The Private sector continued to dominate the investment landscape in both quarters, albeit with a reduced share in Q2. In Q1/FY25, the private sector launched 1,748 projects with investments amounting to Rs 4,95,590.64 crore, representing 76.68 percent of the total investment. In Q2/FY25, the number of projects declined slightly to 1,591, but the investment value increased to Rs 6,05,730.31 crore, accounting for 65.76 percent of total investments. The Q-o-Q growth in private sector investments was 22.22 percent. The bulk of the private investment was directed towards sectors like Automobiles, Machinery and Electronics, Pumped Storage Hydel Power, Solar-Wind Power, and Real Estate. The growing inclination of the private sector towards large-scale investments was evident from the fact that nearly two-thirds of the planned investments in new mega-projects were owned by private enterprises. Of the 173 mega projects worth Rs 6,37,988.45 crore announced in Q2, 107 projects, amounting to Rs 4,17,847.50 crore, were initiated by private companies.

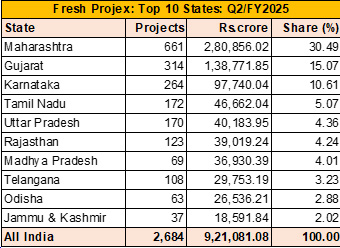

By States

During the second quarter of FY25, Maharashtra continued to dominate new project announcements, witnessing a significant increase in investments. Gujarat, Karnataka, and Tamil Nadu also showed remarkable growth, moving up in rankings and securing top positions. Conversely, states like Uttar Pradesh and Odisha faced declines in fresh investments.

Maharashtra and Gujarat

Maharashtra remained the top state, both in terms of number of new projects and fresh investment. The state witnessed an impressive 107.96 percent increase in fresh investments, growing from Rs 1,35,055.07 crore in Q1/FY25 to Rs 2,80,856.02 crore in Q2/FY25. Correspondingly, its share in total project investment increased from 20.9 percent to 30.49 percent. The state also saw a rise in the number of projects, from 614 to 661. The state entered the poll mode in the second half of October and elected a new government in November 2024. The period saw a decline in new project announcements by both the State government agencies and the Private sector.

Gujarat emerged as the second-largest destination for fresh investments in Q2/FY25, moving up from fifth place in Q1. The state registered a substantial 236.37 percent increase in investment value, rising from Rs 41,256.29 crore in Q1 to Rs 1,38,771.85 crore in Q2. Its share of total investment also grew from 6.38 percent to 15.07 percent.

Other States

Karnataka showed remarkable growth, climbing to the third position in Q2/FY25, with fresh investments amounting to Rs 97,740.04 crore, up 179.5 percent from Rs 34,968.98 crore in Q1. The state's share in total investment rose from 5.41 percent to 10.61 percent because of a couple of new mega Railways, Solar power, Semiconductors, Deepwater Ports, and Roadways projects.

Tamil Nadu also moved up in ranking, securing fourth place in Q2/FY25. The state's investment grew by 84.44 percent to Rs 46,662.04 crore from Rs 25,299.83 crore in Q1, and its share in the overall investment rose to 5.07 percent from 3.91 percent. Tamil Nadu's capex growth was supported by nine mega projects worth Rs. 34,594 crore.

On the other hand, Uttar Pradesh, which was the second-highest recipient of investments in Q1/FY25, experienced a decline of 24.75 percent in Q2/FY25, with investments dropping from Rs 53,401.32 crore to Rs 40,183.95 crore. Consequently, its share in total investments fell from 8.26 percent to 4.36 percent.

Rajasthan maintained relatively stable growth, with a 5.4 percent increase in investments from Rs 37,021.58 crore in Q1/FY25 to Rs 39,019.24 crore in Q2. Similarly, Madhya Pradesh entered the top ten list in Q2/FY25, securing seventh place with Rs 36,930.39 crore worth of new projects, representing a 103.82 percent increase compared to its previous absence in the top ten.

Jammu & Kashmir recorded an extraordinary Q-o-Q growth rate of 1811.13 percent, although the absolute investment value remained comparatively modest at Rs 18,591.84 crore. The state entered the top ten list in Q2/FY25.

While several states showed considerable improvement, others experienced declines. Odisha saw a 36.17 percent reduction in investment value, falling from Rs 41,571.55 crore in Q1/FY25 to Rs 26,536.21 crore in Q2/FY25. Telangana also saw a smaller decline in its share of total investments, despite an 11.17 percent increase in investment value from Rs 26,762.78 crore to Rs 29,753.19 crore. The competition from other states seemed to have impacted these regions, underlining the dynamic nature of investment flows.

Outlook: FY2025

The rise in investments in Q2/FY25 reflects the continued momentum of capital expenditure activities, with a renewed emphasis on infrastructure development. Fresh investments in Q2/FY25 experienced a robust quarter-on-quarter growth of 42.52%, signalling strong project investment activity as the fiscal year progressed.

Looking ahead, ProjectsToday anticipates this upward trend in project investments will persist over the next two quarters. However, the key to unlocking the full potential of these investments lies in swift and effective execution. Ensuring timely implementation of announced projects is crucial for India to not only meet its higher growth aspirations but also generate much-needed employment opportunities.

About Projects Today

Projects Today is India's largest online databank on new and ongoing projects in India. The website, launched on 8 September 2000, aims to provide the required foresight to its clients based on sectoral insights its research team possesses. The project-related information provides an invaluable marketing resource to assist the business development efforts of the organisations that focus on the new projects market. It is widely used by the project fraternity, primarily, as a business opportunity identifier.

Projects Today conducts Survey of Project Investment, at the end of every financial quarter to gauge the trends in projects investment in India by sectors, state, ownership, etc.

Disclaimer : The opinions expressed within this interview are the personal opinions of the interviewee. The facts and opinions appearing in the answers do not reflect the views of Indiastat or the interviewer. Indiastat does not hold any responsibility or liability for the same.

Fresh Investment Grew by 9.9% in Q3/FY25... Read more